A couple of indices went on short term sell today, but none of the indices went on the swing trend sell. Day traders can be short both SPY and QQQ with buy stops at the highs of 199.12 and 100.20.

The swing will go short on a break of 1951 on SP-500

About this blog:

CURRENT MARKET TREND: Down on 1/24/2020

Wednesday, October 29, 2014

SP-500 Sell Stop

The sell-stop on SP-500 should be moved up to 1951.37. If triggered will lock in 51 pts. profit. Also if triggered, you should be short with a stop at the most recent high.

Friday, October 24, 2014

1899 Buy Stop

You all should be profitable and long from your 1899 buy stop. That stop should've been moved down, but I didn't post that so I'll assume that's where we're long from.

The other buy indicators followed AFTER the buy stop. That's why it's better to look at multiple indicators and price at the same time. Some give better entries.

So where are we now?

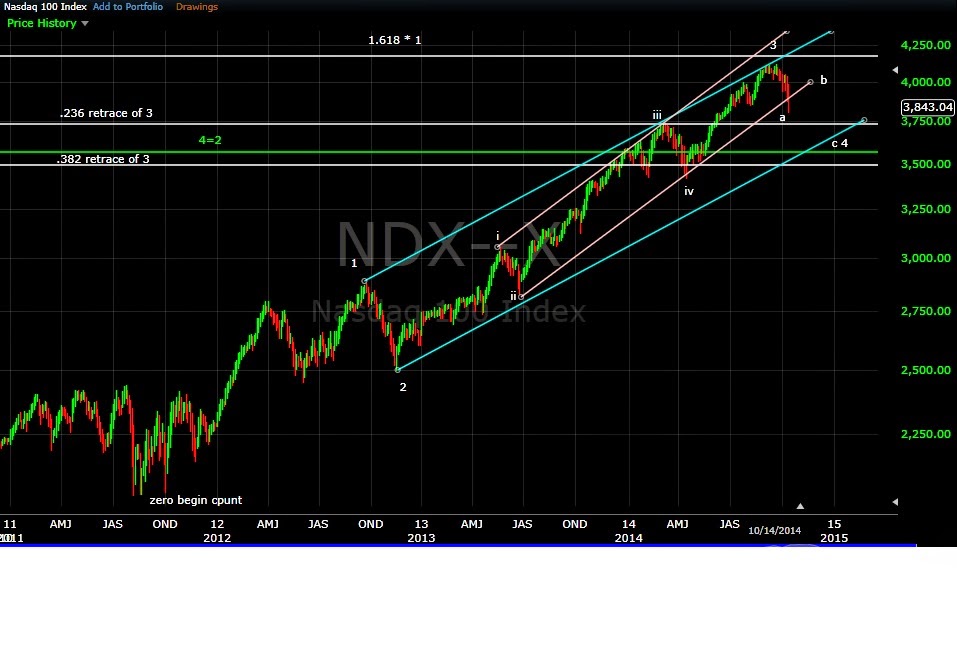

The Swing Trend Indicator, after giving a buy signal last Friday, is now on full buy. The decline we experienced put almost all indicators in medium term, oversold territory. The rally thus far, as powerful as it has been, has yet to move many of these indicators. This means the decline we experienced was probably all of the 4th wave and we're heading up to SP-500 2120 before another vicious decline.

I will try to post some charts and in-depth analysis this weekend.

Schedule: Dogs @ Groomers 8 am, grocery shop, put groceries away, play with Chase, pick up dogs, drop dogs off, pay window cleaning people, pick up boat, pick up Nick, meet Paul at Mississippi launch 45 minutes away, fish the river and catch 20 different species, take pictures, drink beer, listen to Gopher game, have fun, pack up, drop off boat, drop off Nick, cook dinner for wife, play with Chase, put together new changing table, tighten bolts on shitty island kitchen chairs, watch a movie with wife(?)

Yup, life is easy.

The other buy indicators followed AFTER the buy stop. That's why it's better to look at multiple indicators and price at the same time. Some give better entries.

So where are we now?

The Swing Trend Indicator, after giving a buy signal last Friday, is now on full buy. The decline we experienced put almost all indicators in medium term, oversold territory. The rally thus far, as powerful as it has been, has yet to move many of these indicators. This means the decline we experienced was probably all of the 4th wave and we're heading up to SP-500 2120 before another vicious decline.

I will try to post some charts and in-depth analysis this weekend.

Schedule: Dogs @ Groomers 8 am, grocery shop, put groceries away, play with Chase, pick up dogs, drop dogs off, pay window cleaning people, pick up boat, pick up Nick, meet Paul at Mississippi launch 45 minutes away, fish the river and catch 20 different species, take pictures, drink beer, listen to Gopher game, have fun, pack up, drop off boat, drop off Nick, cook dinner for wife, play with Chase, put together new changing table, tighten bolts on shitty island kitchen chairs, watch a movie with wife(?)

Yup, life is easy.

Monday, October 20, 2014

Swing Trend Indicator

The Swing Trend Indicator gave a tentative buy signal and a trigger buy signal on Friday, October 17th.

Wednesday, October 15, 2014

Tuesday, October 14, 2014

Looking for indications of a bottom

I apologize for the lack of posts, been busy with the new house and child. Still figuring out my time management.

I am on the lookout for a medium term low, bounce, and then downside to resume.

Stop-losses on the SP-500 should be at 1899 with 1899 being a buy stop (meaning you should get long above 1899 with stop-losses set at the prior low).

The VIX barely closed back inside it's upper BB. A close below 22.79 tomorrow issues an equity buy signal:

The RUT has entered into it's 4th wave FSZ (Fib Support Zone). Wave 4 =.382* wave 3 and wave 4 = wave 2. The ADX is nicely above the 40 line saying a trend reversal is due. There are two ways to trade the ADX, on a straight up rollover which has produced as much as 50 points drawdown before a reversal in the past, or by waiting for the ADX to dip back under the 40 line. The latter has produced 20 point max drawdowns. I can't rule out new lows, but I think new lows are buying opportunities.

Stops on the RUT should be at 1098:

RSI on SPX/VIX is in an area that has produced lows before, although a touch of the 30 line gives better signals:

VIX/VXV over 1 should always have bears worried:

The NYHLR was under .10 at one point:

I am on the lookout for a medium term low, bounce, and then downside to resume.

Stop-losses on the SP-500 should be at 1899 with 1899 being a buy stop (meaning you should get long above 1899 with stop-losses set at the prior low).

The VIX barely closed back inside it's upper BB. A close below 22.79 tomorrow issues an equity buy signal:

The RUT has entered into it's 4th wave FSZ (Fib Support Zone). Wave 4 =.382* wave 3 and wave 4 = wave 2. The ADX is nicely above the 40 line saying a trend reversal is due. There are two ways to trade the ADX, on a straight up rollover which has produced as much as 50 points drawdown before a reversal in the past, or by waiting for the ADX to dip back under the 40 line. The latter has produced 20 point max drawdowns. I can't rule out new lows, but I think new lows are buying opportunities.

Stops on the RUT should be at 1098:

RSI on SPX/VIX is in an area that has produced lows before, although a touch of the 30 line gives better signals:

VIX/VXV over 1 should always have bears worried:

The NYHLR was under .10 at one point:

Subscribe to:

Comments (Atom)